Ohio Minimum Wage - What You Need To Know

For many folks working hard across Ohio, the idea of a minimum wage is more than just a number; it's a fundamental part of how they make ends meet. It sets a base level for what people can expect to earn for their time and effort, and it plays a pretty big role in the daily lives of countless individuals and families. This basic pay rate helps shape budgets, influence spending, and, in some respects, affects the overall well-being of communities all over the state.

You know, it's actually a topic that comes up quite a bit, and for good reason. The amount someone earns per hour at the very least can really impact their ability to cover everyday costs, like putting food on the table or keeping a roof over their heads. So, keeping up with what the current rate is, and how it changes, feels pretty important for anyone working here or even for businesses trying to figure out their payroll. It’s a standard that’s designed to offer some protection, making sure that there’s a floor beneath earnings, which, you know, is sort of like a basic safety net for workers.

Sometimes, figuring out all the ins and outs of this can feel a bit like trying to solve a puzzle, especially when there are different rules for different types of jobs or businesses. It’s not always as straightforward as just one simple number for everyone. People often have questions about who it applies to, what happens if things don’t seem quite right, or what the future might hold for these rates. This article aims to clear up some of that, giving you a clearer picture of what the minimum wage means for Ohio, and how it all works, so you can feel a little more informed.

Table of Contents

- What's the Current Minimum Wage in Ohio?

- How Does Ohio's Minimum Wage Get Set?

- Who Does the Ohio Minimum Wage Affect Most?

- Are There Exceptions to Ohio Minimum Wage Rules?

- What Happens If Minimum Wage Requirements Aren't Met in Ohio?

- Getting Help with Ohio Minimum Wage Questions

- What's Next for the Minimum Wage in Ohio?

- Looking Ahead for Ohio Minimum Wage

What's the Current Minimum Wage in Ohio?

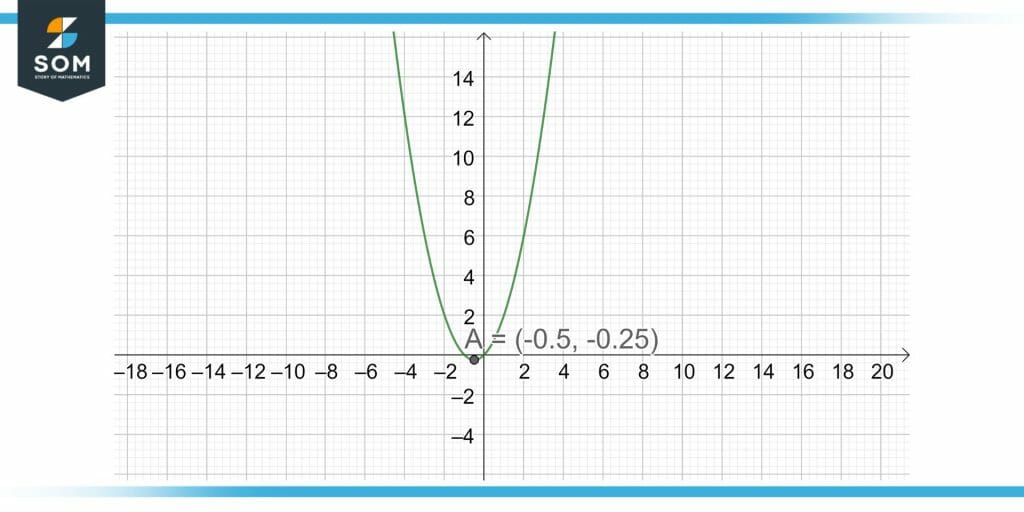

So, you might be wondering, what's the actual number right now for the minimum wage here in Ohio? Well, as a matter of fact, the state's minimum wage changes a little bit each year, usually at the start of January. This adjustment is tied to the cost of living, which means it tries to keep up with how much things like groceries and rent are going up. It’s a way to make sure that the lowest amount someone can earn has some connection to what it actually costs to live. For instance, sometimes the lowest amount you can legally pay is also the very lowest amount that anyone can really get by on, almost like how in some math examples, the absolute lowest point a function reaches can also be the point where it just barely touches the bottom line.

There are a few different rates to keep in mind, too. For most workers in Ohio, there’s one main rate, but for businesses that don't bring in a lot of money each year, there's a slightly different, lower amount they can pay. And then, for people who earn tips, like servers or bartenders, their base pay can be even lower, because their tips are expected to make up the difference to reach the full minimum wage. It's a bit like trying to figure out a minimum value from a bunch of different numbers, some of which might even be zero, and those numbers aren't all lined up nicely in a row; you really have to look at each piece to get the full picture, which is sometimes what it feels like when you're trying to calculate what someone actually earns when tips are involved. This can get a little tricky for people trying to understand their paychecks, honestly.

It's pretty important to know which rate applies to you or your business, because getting it wrong can cause some real headaches. The state tries to make this information easy to find, often publishing it on official websites and requiring employers to post it where workers can see it. But even with that, people sometimes get confused. It's a bit like when you're trying to use a new feature on a computer program and you're just not sure if you're doing it right, or if the system even supports what you're trying to do, like when someone gets a message saying their computer doesn't support DirectX 12; it just leaves you scratching your head, really.

How Does Ohio's Minimum Wage Get Set?

The way Ohio’s minimum wage is determined is actually pretty interesting, and it’s different from how some other states handle it. In Ohio, the process is tied to a constitutional amendment that voters approved a while back. This means it’s not just something that lawmakers can change on a whim with a simple vote; it’s built right into the state's most important rule book. Because of this, the rate goes up automatically each year, usually based on how much the cost of living has increased, as measured by a certain economic index. This happens every January first, so you can kind of expect a small bump around that time, which is something many people look forward to, of course.

This automatic adjustment is meant to help workers keep pace with rising prices. Without it, the buying power of the minimum wage would slowly get eaten away by inflation, meaning people could afford less and less with the same amount of money over time. It's almost like trying to fill a bucket with a tiny hole in the bottom; if you don't keep adding water, the level just keeps dropping. So, this annual tweak is a way to try and maintain the value of that lowest hourly rate. It’s a pretty clever system in some respects, designed to provide a bit of stability for those earning the least.

Now, while the state constitution sets this general rule for how the minimum wage changes, there are still discussions and efforts to propose further changes, sometimes through new ballot initiatives or legislative action. These might aim to raise the minimum wage even higher than the automatic adjustments, or to change who it applies to. These efforts often bring up a lot of talk about what a fair wage really is, what businesses can afford, and what’s best for the overall economy. It’s a conversation that has a lot of moving parts, and you know, it often feels like there are many different viewpoints on what the absolute lowest acceptable pay should be, and frankly, not every proposal or idea ends up making it through.

Who Does the Ohio Minimum Wage Affect Most?

When we talk about the Ohio minimum wage, it’s really about a lot of people, probably more than you might first think. Typically, it has the biggest impact on folks working in entry-level jobs, like those in fast food, retail, or certain service industries. These are often positions that don't require a lot of prior experience or specialized training, and they can be a starting point for many individuals, including younger workers, students, or those re-entering the job market. So, it really sets the groundwork for their financial beginnings, you know, providing that very first step up for many.

But it's not just young people or those just starting out. The minimum wage also plays a role for many adults who might be supporting families, or who are working part-time jobs to supplement other income. Sometimes, people are working multiple jobs, each paying the minimum, just to piece together enough money to cover their household expenses. For these individuals, every extra cent per hour can make a real difference in their daily lives, helping them stretch their budgets a little further. It’s like, when you're trying to figure out how much storage you need for a new computer setup, you want to make sure you have the bare minimum, but also enough to actually get things done comfortably; every little bit counts, and it's the same for income.

Interestingly, the effects of the minimum wage can also ripple out to other workers who earn just above that lowest rate. If the minimum wage goes up, sometimes employers will also give small raises to those earning a bit more, just to keep things fair and to keep their pay scales somewhat consistent. So, while it directly helps those at the very bottom, it can indirectly lift up others too. It's a bit like a rising tide, which, you know, can lift all boats, even if some are already floating a little higher. This means the Ohio minimum wage actually touches a wider group of people than just those earning the exact hourly floor.

Are There Exceptions to Ohio Minimum Wage Rules?

Yes, as a matter of fact, there are some situations where the standard Ohio minimum wage rules don't quite apply, or where different rates come into play. It's not a one-size-fits-all kind of deal, which can sometimes make things a little confusing for people trying to figure out their own pay. One big exception, as we touched on earlier, is for businesses that have a very small annual gross income. If a business brings in less than a certain amount of money each year, they might be allowed to pay a slightly lower hourly rate. This is meant to help very small operations keep their doors open, especially those just starting out, so, in a way, it's a measure to support small businesses.

Another common exception is for tipped employees, like waiters and waitresses. Their employers can pay them a lower direct hourly wage, because it's expected that their tips will bring their total earnings up to at least the full minimum wage. If, for some reason, their tips plus their hourly wage don't add up to the minimum wage, the employer is supposed to make up the difference. This can sometimes lead to misunderstandings, and it's a situation where it feels like you're trying to figure out a minimum value from a collection of numbers that aren't always continuous or easily added up, like when you're trying to get a total from scattered cells in a spreadsheet, some of which might even be zero. It definitely requires careful tracking.

There are also specific rules for things like learners, apprentices, and certain student workers, where a lower wage might be allowed for a limited time while they are gaining skills or experience. Plus, some non-profit organizations or government agencies might have different guidelines. It's important to remember that these exceptions are usually pretty specific, and they don't mean that employers can just pay whatever they want. There are still minimums that apply, even if they're different from the main rate. It's almost like how sometimes a feature you're trying to use has very specific requirements, and if those minimum requirements aren't met, the connection just doesn't happen, which, you know, can be really frustrating, especially if you need support right away.

What Happens If Minimum Wage Requirements Aren't Met in Ohio?

If an employer in Ohio isn't paying at least the minimum wage, or if they're not following the rules about overtime or tipped wages, that's a serious issue, and there are steps that can be taken. It's not just a minor oversight; it's actually against the law. When people find themselves in this situation, it can feel incredibly confusing and upsetting, almost like when you're trying to fix a remote desktop connection and you keep running into problems, especially when you need help in an emergency. You might feel totally lost, like you genuinely don't know what to do because it's left you scratching your head.

Workers who believe they aren't being paid fairly have the right to file a complaint with the Ohio Department of Commerce, Wage and Hour Division. This state agency is responsible for looking into these kinds of issues and making sure that employers are following the rules. They can investigate claims, ask for records, and, if they find that wages are owed, they can help workers get back the money they should have earned. It’s a bit like when a computer connection drops because the very basic "security" wasn't up to snuff; if the basic requirements for fair pay aren't there, the system, in a way, needs to be fixed to ensure justice.

Sometimes, simply reaching out to the employer to clarify a paycheck issue can resolve things, especially if it was an honest mistake. But if that doesn't work, or if the employer refuses to correct the problem, then going to the state agency is the next logical step. There are also legal avenues, and some workers might choose to consult with an attorney who specializes in employment law. It's really important for people to know their rights and to understand that there are resources available to help them if they're not getting paid what they're due. After all, everyone deserves to be compensated fairly for their hard work, and there are protections in place to try and make sure that happens, you know, to make sure those minimums are actually met.

Getting Help with Ohio Minimum Wage Questions

It’s pretty common to have questions about your pay, especially when the rules can feel a bit complex, like the Ohio minimum wage guidelines. If you're unsure about whether you're being paid correctly, or if you just want to understand the current rates better, there are several places you can turn for assistance. You don't have to figure it all out on your own, and honestly, many people report having similar questions or issues, so you're certainly not alone in feeling a bit puzzled. It's a bit like when a number of users report the same error; it just means it's a common point of confusion, and there are usually resources to help clear it up.

The Ohio Department of Commerce, specifically their Wage and Hour Division, is a great place to start. They have staff who can explain the laws, answer your specific questions, and provide guidance on how to proceed if you think there’s a problem. Their website also often has helpful information, including current wage rates and details on how to file a complaint. They are, essentially, the main point of contact for these kinds of inquiries, and they are usually pretty good about giving clear answers, which is helpful, you know.

Beyond state agencies, there are also non-profit organizations and legal aid groups that sometimes offer free or low-cost advice on employment matters. These groups can be particularly helpful if your situation is complicated or if you need more personalized guidance. For instance, if you're trying to figure out what your minimum pay should be when your work hours are irregular or when your income comes from various sources, and it's not a straightforward calculation, these kinds of experts can really help untangle things. It's a bit like needing help to determine a minimum from selected, non-continuous data points; you need someone who knows how to put all the pieces together to see the true picture. Don't hesitate to reach out if you're feeling unsure; getting good information is the first step to making sure you're treated fairly.

What's Next for the Minimum Wage in Ohio?

Looking ahead, the discussion around the minimum wage in Ohio is likely to keep going, as it does in many places across the country. While the current system has an automatic annual adjustment based on inflation, there are often calls for more significant increases. These conversations usually involve a lot of different viewpoints: some argue that the current minimum isn't enough for people to live on comfortably, while others worry about how higher wages might affect businesses, especially smaller ones. So, it’s a pretty complex issue with many different sides to consider, which is, you know, typical for something that impacts so many people.

There are often groups and advocates who push for new ballot initiatives or legislative changes to raise the minimum wage beyond what the automatic adjustments provide. These proposals might aim for a higher flat rate, or they might suggest a pathway to a "living wage" that's specifically calculated to cover basic expenses in different areas. For instance, some argue that the current minimum doesn't meet the "minimum security requirements" for a family to truly thrive, and that a higher baseline is needed to ensure people aren't just barely getting by. These discussions are always happening, and sometimes they gain a lot of traction, honestly.

The economic climate also plays a big part in these discussions. Things like inflation rates, unemployment numbers, and the overall health of the state's economy can influence how people feel about raising the minimum wage. If prices for everyday goods continue to climb, the pressure to increase the lowest hourly pay often grows stronger. It's a bit like trying to decide the minimum storage you'll need for a new computer; you want to make sure you have enough for today, but also a little extra for what might come tomorrow. So, keeping an eye on these broader economic trends can give you a pretty good idea of where the conversation about the Ohio minimum wage might head next.

Looking Ahead for Ohio Minimum Wage

So, as we consider what's next for the Ohio minimum wage, it’s pretty clear that this isn't a topic that just sits still. It’s always in motion, shaped by economic shifts, public discussions, and sometimes even new proposals from different groups. The automatic adjustments are one piece of the puzzle, providing a predictable, if sometimes small, increase each year. But the bigger changes often come from wider movements, either through people voting directly on the issue or through lawmakers considering new bills. It's a dynamic situation, really, and it touches on some pretty fundamental ideas about fairness and economic well-being for everyone.

We'll likely continue to see debates about what constitutes a truly fair wage, especially in different parts of the state where the cost of living can vary quite a bit. What might be a sufficient minimum in a smaller town could feel very different in a larger city. These regional differences are often part of the conversation, as people try to figure out if a single statewide minimum wage is the best approach, or if there should be more localized rates. It's a complex problem, and you know, sometimes it feels like trying to find a clear minimum when the "set" of conditions isn't perfectly uniform across the board, which can be quite challenging.

Ultimately, the future of the Ohio minimum wage will probably be a reflection of ongoing conversations about economic justice, business sustainability, and the overall health of our communities. It’s a topic that affects so many people directly, from the person earning that hourly rate to the business owner trying to manage their costs. Keeping informed about these discussions and understanding the different perspectives can help everyone participate in shaping what comes next for workers and businesses across Ohio. It’s a pretty important conversation, and it’s one that will surely continue to evolve, so it’s worth paying attention to, frankly.

Minimum | Definition & Meaning

How Minimum Wage Works: Federal & State

Minimum Value of a Function | Definition, Methods & Examples - Lesson