Westerra Credit Union - Your Financial Partner

Westerra Credit Union is a financial helper that truly cares about the people it serves, making sure banking feels easy and supportive for everyone. They work to make a real difference in people's lives, not just by handling money but by giving personal attention and helping folks learn more about their finances. It's about building lasting connections, actually, where your financial well-being is at the very heart of what they do.

This organization offers a wide array of services, from everyday banking needs like checking and savings accounts to more significant life moments such as getting a home loan. You can, you know, handle many things right from your phone or computer, making it pretty convenient for busy schedules. They also have physical places you can visit if you prefer, with people ready to chat and lend a hand.

Whether you're looking to manage your daily spending, save up for something big, or even start a business, Westerra has ways to help you out. They aim to be a place where you feel understood and supported, so it's almost like having a trusted friend for your money matters.

Table of Contents

- Westerra Credit Union - Banking Made Simple

- How Does Westerra Credit Union Help You Manage Your Money?

- Where Can You Find Westerra Credit Union?

- What Kinds of Financial Help Does Westerra Credit Union Provide?

- What Are the Current Rates at Westerra Credit Union?

- Is Your Money Safe with Westerra Credit Union?

- What Do People Say About Westerra Credit Union?

- How Does Westerra Credit Union Make a Difference?

Westerra Credit Union - Banking Made Simple

Online Banking and Access with Westerra Credit Union

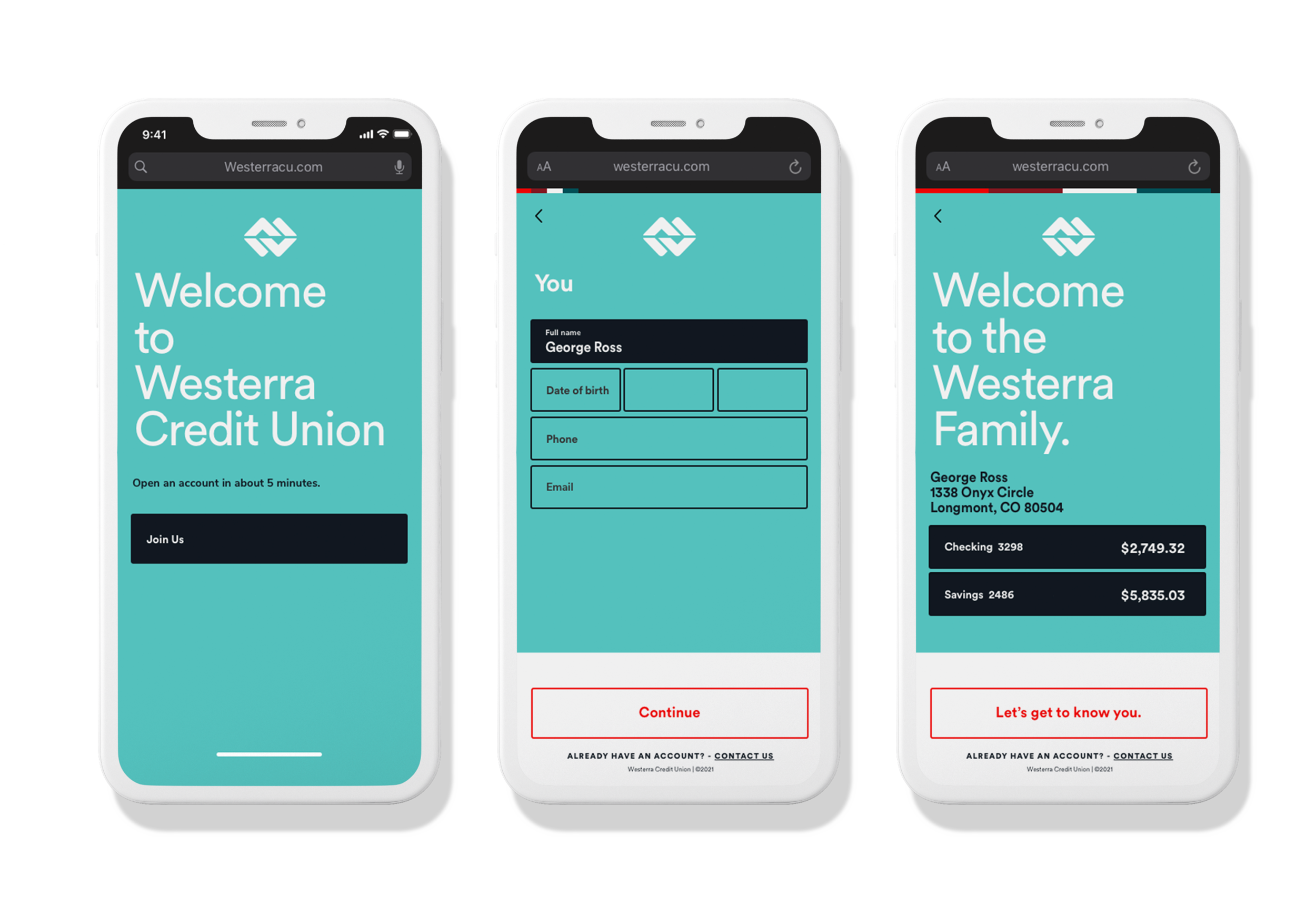

Westerra makes it pretty straightforward to manage your finances, actually, by providing online banking that’s ready for you around the clock, every single day. This means you can, you know, handle things like sending payments to others, taking a quick look at how much money you have in your different accounts, and doing a whole lot of other useful tasks, all from the comfort of your home computer or your mobile device. It’s set up to be very convenient, allowing you to take care of your money matters whenever it suits your schedule, which is really helpful for people with busy lives.

You can also, like, put checks into your account without going anywhere, pay your household bills, and sign up for statements and important notices that come to you electronically. This way, it’s really easy to keep track of your money and paperwork without having to deal with physical mail or paper clutter. So, it's all about making your financial life a bit smoother and less complicated, giving you more time for other things.

Getting to your account details is pretty simple, too, whether you're at home relaxing or out and about living your day. You can look at your history of money coming in and going out, and manage your funds using their digital services, which are available through a website or a phone application. It’s put together to be very user-friendly, basically, so you don't have to worry about complicated steps or confusing instructions when you need to check on your money.

They have a tool, too, that helps you find a Westerra location or a money machine close to where you are right now. You can use a visual map or a detailed list of spots to find the one that's most convenient for you, which is helpful when you need to do something in person, like getting cash or speaking with someone about your account. It takes the guesswork out of finding a place to do your banking, really.

How Does Westerra Credit Union Help You Manage Your Money?

Personal and Business Services at Westerra Credit Union

Westerra offers a range of ways to help people with their money, from personal accounts for individuals to specific services for businesses, large and small. They have checking accounts for your daily spending needs, savings accounts to help you put money aside for future goals, and options for borrowing when you need a bit of extra help, like for a big purchase. They also have services for those who own a business, so, they cover a lot of ground for different financial situations.

For those who want to buy a home, Westerra believes that getting a place of your own is more reachable than you might think, and they express a commitment to being with you, you know, every step of the way. They understand that the whole process of buying a home can feel like a big undertaking, so they try to make it less stressful and more understandable for you. It’s about providing support and guidance, essentially, through what can be a very important time.

They also offer help with getting money for different reasons, like for a business venture or for a home improvement project you're planning. You can find out what kind of interest rates are available for things like business loans, or for home equity lines of credit, which let you use the value in your home. It's a way, really, to see what options you have for getting funds for your specific plans, allowing you to compare and decide what works best.

Their community, they say, is built on real connections with people, not just on money going back and forth between accounts. While doing transactions is easy and works well for everyone, they focus on being there for you with genuine help for your personal money goals, whatever those might be. It’s about building a relationship, essentially, where you feel heard and supported, rather than just being another account number.

Where Can You Find Westerra Credit Union?

Finding a Westerra Credit Union Location

If you're looking to visit Westerra in person, you can use their handy tool to find a branch or a money machine nearby, making it quite convenient. You can search by your current spot, by a street address you know, or by a zip code. This makes it pretty simple to find a spot when you need to, whether you're at home or out exploring a new area, so you're never left wondering where to go.

For example, their location in Aurora, Colorado, specifically on Quincy Avenue and Buckley Road, has a full range of banking solutions all in one place. This means you can do everything from your daily banking activities to getting help with a home loan, you know, without having to go to different places for different needs. It’s designed to be a one-stop spot for many of your financial requirements.

There's also a convenient Westerra spot in Parker, Colorado, which also has a full set of banking solutions made to fit how you live your life and your unique financial needs. They offer everything from regular banking services and round-the-clock money machine access to help with mortgages and business needs. It’s pretty comprehensive, actually, ensuring that a wide variety of services are available in one accessible place.

Another location, on Union Blvd in Lakewood, Colorado, also brings a complete set of banking solutions together under one roof. So, whether it's your everyday money needs, like depositing a check, or getting cash from a machine at any time of day or night, they have you covered in these spots. They aim to make banking as easy and straightforward as possible for their members.

The Green Mountain branch, also in Lakewood, Colorado, has been around since 1934, making it a well-established part of the community. It’s a long-standing presence, offering its services from that specific spot. You can find out its address, phone number, hours of operation, and what services it provides there, too, making it simple to plan your visit.

What Kinds of Financial Help Does Westerra Credit Union Provide?

Westerra Credit Union Products and Services

Westerra Credit Union offers a variety of ways to help with your money, including loans for different purposes you might have, savings accounts to help you grow your money over time, checking accounts for everyday use, and credit cards for your spending needs. They also provide online banking for people in Denver, Colorado, and other nearby areas. So, they have quite a bit available to help you manage your financial life.

You can, you know, compare loan rates and other financial services that Westerra offers with what other places might have available. This helps you make choices that are good for your own money situation, allowing you to pick the best fit for your needs. It’s about being informed, really, so you can feel confident in your financial decisions.

They also make it easy to reach them if you have questions or need some help with your accounts. You can get in touch by phone, by sending an email, or by going to one of their physical locations close to you. This way, you have a few different ways to get the support you need, which is helpful when you have an urgent question or just need to talk things over.

Online banking lets you look at your deposits and withdrawals, see all your account activity, get electronic statements instead of paper ones, and move money between your Westerra accounts with ease. It’s free to use and available every hour of every day, seven days a week, so you can manage your money whenever it suits you best, whether it's late at night or early in the morning.

What Are the Current Rates at Westerra Credit Union?

Understanding Rates at Westerra Credit Union

You can find out the current rates for various types of loans and savings options at Westerra Credit Union, which is pretty useful information for planning. This includes rates for things like bridge loans, which help you with a short-term need, business loans for your company, certificates of deposit (which are ways to save money for a set time at a fixed rate), and IRAs (retirement savings accounts). It’s all there for you to look at, so you can make informed choices.

They also provide rates for home equity lines of credit (HELOCs) and home equity loans. These are ways to borrow money using the value you’ve built up in your home, which can be a good option for larger expenses. Knowing these rates helps you plan your financial moves, so, it’s pretty useful information to have when you're thinking about borrowing for a big project or purchase.

It's worth noting that the rates you get might depend on your own history with credit, and these rates can change without a lot of warning, so it’s always good to check the very latest numbers. There might also be other rates and terms that apply for larger loans, too, so it’s good to check the specifics for what you need before making any decisions. This ensures you have the most accurate information for your situation.

Is Your Money Safe with Westerra Credit Union?

Westerra Credit Union and Deposit Insurance

Your money at Westerra Credit Union is, actually, federally insured up to at least $250,000. This protection comes from the National Credit Union Administration (NCUA), which is a part of the United States government. This means your savings are backed by the full trust and support of the government, which is a good thing to know and provides a strong sense of security for your funds.

This federal insurance gives members a sense of security, knowing that their money is protected even if something unexpected were to happen. It's a standard feature for credit unions, providing a strong layer of safety for your deposits. So, you can feel pretty comfortable about keeping your money there, knowing it’s looked after.

The NCUA, you know, also provides reports on credit unions, using financial and statistical details gathered from each one. This helps keep things clear and accountable for everyone involved, from the credit union itself to its members and the public. It’s a way to ensure transparency in how these financial institutions operate.

For instance, according to the NCUA, Westerra Credit Union has a significant number of active money market accounts, holding a substantial amount of money for members in Denver, Colorado, and all other service areas. This gives you a bit of a picture of their financial standing and how many people trust them with their savings, which is pretty telling.

What Do People Say About Westerra Credit Union?

Westerra Credit Union Reviews and Feedback

You can get a good idea of what other people think about Westerra Credit Union by looking at reviews from fellow consumers who have used their services. These reviews are meant to be unbiased, giving you the full story from people who have actually experienced what Westerra offers. It’s helpful, really, to hear from others who have been in your shoes and can share their insights.

Finding out about things like their assets, who can become a member, how they check deposits, and what customers say about them is pretty straightforward. This kind of information helps you get a complete picture of what Westerra is all about, so you can decide if it’s the right place for your financial needs. It’s all about giving you the details you need to make a good choice.

They also, you know, send out year-end tax information to you by mail, usually by January 31st of the next

Westerra Credit Union - Coda Construction

Westerra Credit Union — Elliott For Hire

Westerra Credit Union — Elliott For Hire