Unlock Financial Freedom: The Power Of Mercantil En Línea Banking

Table of Contents

- The Evolution of Banking: Why Online is Key

- What Exactly is Mercantil en Línea?

- Getting Started: Your First Steps with Mercantil en Línea

- Beyond Basic Transactions: Advanced Capabilities

- The YMYL Aspect: Trust and Responsibility in Digital Banking

- Mercantil Banco Universal: A Legacy of Trust

- Troubleshooting Common Issues and Getting Support

- The Future of Banking: Innovation with Mercantil en Línea

The Evolution of Banking: Why Online is Key

The banking sector has undergone a seismic shift over the past few decades, moving from brick-and-mortar exclusivity to a predominantly digital landscape. This evolution wasn't merely about convenience; it was a response to changing consumer needs, technological advancements, and the globalized nature of modern life. Online banking, exemplified by services like Mercantil en Línea, offers a suite of advantages that traditional banking simply cannot match. Firstly, accessibility is paramount. With online banking, geographical barriers dissolve. Whether you're at home, in the office, or traveling abroad, as long as you have an internet connection, your bank is at your fingertips. This constant access means urgent transactions can be completed without delay, and financial information is always current. Secondly, efficiency is significantly boosted. Tasks that once required a physical visit, such as transferring funds, paying bills, or checking balances, can now be executed in mere moments. This saves invaluable time and reduces the logistical complexities of financial management. Moreover, online platforms often provide a more comprehensive overview of one's financial standing. Integrated tools, historical transaction data, and budgeting features empower users to make more informed decisions. The shift to digital also aligns with environmental consciousness, reducing the need for paper statements and physical documents. For a financial institution like Mercantil Banco Universal, embracing this digital frontier through Mercantil en Línea is not just about staying competitive; it's about fulfilling its mandate to provide secure, reliable, and accessible financial services to its clientele in the 21st century. The ability to perform "operaciones electrónicas cotidianas" (everyday electronic operations) securely and efficiently is the bedrock of this modern banking paradigm.What Exactly is Mercantil en Línea?

At its core, **Mercantil en Línea** is Mercantil Banco Universal's internet banking service, designed to empower users to manage their finances from virtually any location. It serves as the primary digital gateway to all the banking services offered by Mercantil Banco Universal. Imagine having a secure, personalized branch accessible 24/7, right from your computer, tablet, or smartphone. That's precisely what Mercantil en Línea offers. The platform is built on the premise of convenience, security, and comprehensiveness. It transforms the often complex world of personal finance into an intuitive digital experience. As the official description states, "Mercantil en línea es la entrada a mercantil banco universal a través de internet, la cual le permite manejar sus finanzas desde la comodidad de su casa, oficina o desde cualquier lugar del mundo." This encapsulates its essence: boundless access to your financial world. Whether you need to check your account balance before a purchase, send money to a family member, or pay your utility bills, Mercantil en Línea provides the tools to do so swiftly and securely.Core Features and Benefits for Personal Users

For the everyday user, Mercantil en Línea is packed with functionalities that streamline personal financial management. The platform is designed to handle a wide array of "operaciones electrónicas cotidianas" (everyday electronic operations) with ease. Here are some of the key features and their benefits: * **Fund Transfers:** One of the most frequently used features, Mercantil en Línea allows for instant transfers between your own Mercantil accounts, to other Mercantil accounts, and to accounts in other banks, both nationally and internationally (where applicable). This eliminates the need for physical checks or bank visits. * **Bill Payments:** From electricity and water to internet and phone bills, the platform enables you to pay a multitude of services directly, often with options for scheduling recurring payments. This ensures bills are paid on time, avoiding late fees. * **Balance Inquiries and Transaction History:** Users can instantly view their current balances across all linked accounts (checking, savings, credit cards, debit cards, mobile accounts). A detailed transaction history provides a clear record of all financial activities, aiding in budgeting and reconciliation. * **Mobile Top-Ups and Recharges:** Easily recharge mobile phone credit or other prepaid services directly from your bank account, a particularly convenient feature in regions where mobile payments are prevalent. * **Service Requests:** Beyond transactions, Mercantil en Línea often allows users to request various banking services online, such as new checkbooks, statement requests, or even loan applications, reducing the need for branch visits. * **Account and Card Management:** Access and manage details for your bank accounts, credit cards, debit cards, and even mobile accounts associated with Mercantil. This includes activating/deactivating cards, setting spending limits, or reporting lost/stolen cards. * **Personalized Alerts:** Many online banking platforms, including Mercantil en Línea, offer the option to set up alerts for specific activities, such as large transactions, low balances, or incoming deposits, keeping you informed in real-time. The overarching benefit of these features is the unparalleled control and visibility they offer over your finances. This empowerment is crucial in a world where financial decisions often need to be made quickly and efficiently.Security Measures: Protecting Your Digital Assets

When it comes to online banking, security is not just a feature; it's the foundation upon which trust is built. For a YMYL (Your Money or Your Life) service like Mercantil en Línea, safeguarding user data and transactions is paramount. Mercantil Banco Universal employs a multi-layered approach to ensure the confidentiality and integrity of its online platform. The statement "La información mostrada en esta página es confidencial" underscores this commitment. Key security measures typically include: * **Encryption:** All data transmitted between your device and Mercantil en Línea servers is encrypted using industry-standard protocols (e.g., SSL/TLS). This scrambles your information, making it unreadable to unauthorized parties. * **Multi-Factor Authentication (MFA):** While the provided data mentions "Necesitas usuario o tarjeta de débito y clave de internet," modern online banking often goes beyond a simple username and password. MFA might involve a one-time password (OTP) sent to your registered phone, a security token, or biometric authentication (fingerprint/face ID) for enhanced security. This adds an extra layer of protection, ensuring that even if your password is compromised, unauthorized access is prevented. * **Secure Login Procedures:** The system requires a unique user ID or debit card number along with a secure internet password ("clave de internet"). This combination is designed to verify the user's identity before granting access to sensitive financial information. * **Fraud Monitoring:** Banks continuously monitor transactions for unusual patterns or suspicious activities. Sophisticated algorithms and human oversight work in tandem to detect and prevent fraudulent transactions. * **Firewalls and Intrusion Detection Systems:** Robust network security infrastructure protects Mercantil en Línea from external threats and unauthorized access attempts. * **Regular Security Audits and Updates:** Financial institutions regularly audit their systems for vulnerabilities and apply necessary security patches and updates to counter evolving cyber threats. * **User Education:** Banks often provide guidelines and tips to users on how to protect themselves online, such as creating strong passwords, being wary of phishing attempts, and ensuring their devices are secure. By implementing these stringent security measures, Mercantil en Línea aims to provide a safe and reliable environment for all your electronic operations, fostering the trust essential for managing your money online.Getting Started: Your First Steps with Mercantil en Línea

Embarking on your journey with Mercantil en Línea is designed to be a straightforward process, allowing you to quickly gain access to your financial accounts. The fundamental requirement, as stated, is having a "usuario o tarjeta de débito y clave de internet." This means you'll need to be an existing customer of Mercantil Banco Universal with an active account and have registered for their online banking service. Typically, the process involves a few key steps: 1. **Account Opening:** First and foremost, you must have an account (checking, savings, or other) with Mercantil Banco Universal. If you don't, this would be your initial step, usually completed at a physical branch or through their official website if they offer online account opening. 2. **Online Banking Registration:** Once you have an account, you'll need to register for Mercantil en Línea. This often involves visiting the bank's official website and locating the "Mercantil en Línea" portal. There will usually be an option for "New User Registration" or "Register for Online Banking." 3. **Identity Verification:** During registration, you'll be prompted to provide identifying information, which might include your ID number, account number, or debit card details. This step is crucial for security and linking your physical accounts to your online profile. 4. **Creating Your Credentials:** You will then create your unique "usuario" (username) and "clave de internet" (internet password). It's vital to choose a strong, complex password that is not easily guessable and to keep it confidential. The system may also guide you through setting up security questions or other verification methods. 5. **First Login:** Once registered, you can proceed to the login page. The phrase "Bienvenidos a mercantil en línea para ingresar a mercantil en línea presione aquí" indicates a clear entry point. You'll enter your newly created username/debit card number and internet password. 6. **Accepting Terms and Conditions:** Upon your first successful login, you might be asked to review and accept the terms and conditions of the service, which outlines your responsibilities and the bank's commitments regarding the online platform. It's important to remember that Mercantil en Línea is your personal portal. Just as you wouldn't share your physical wallet, your online banking credentials should be guarded with the utmost care. The ease of access provided by Mercantil en Línea comes with the responsibility of maintaining the security of your login information.Beyond Basic Transactions: Advanced Capabilities

While Mercantil en Línea excels at facilitating everyday transactions like transfers and payments, its capabilities extend far beyond these basic functions. The platform is designed to offer a comprehensive suite of tools that provide deeper financial control and convenience, catering to a wide range of user needs. These advanced features underscore the bank's commitment to providing a holistic digital banking experience.Managing Multiple Accounts and Cards

One of the significant advantages of Mercantil en Línea is the ability to view and manage all your Mercantil financial products from a single, unified interface. This means you can: * **View All Account Types:** Whether you have multiple checking accounts, savings accounts, or even specialized investment accounts with Mercantil Banco Universal, they are typically all accessible and viewable within your Mercantil en Línea profile. This provides a consolidated financial overview, eliminating the need to log into separate portals or track different accounts manually. * **Credit and Debit Card Management:** "Accede a tu cuenta bancaria, tarjeta de crédito, débito o móvil de mercantil." This statement highlights the integration of card management. Users can check credit card statements, monitor debit card transactions, view available credit limits, and even perform actions like activating new cards, reporting lost or stolen cards, or temporarily blocking a card if suspicious activity is detected. This immediate control over your cards is a critical security and convenience feature. * **Mobile Account Integration:** With the rise of mobile payments and digital wallets, Mercantil en Línea also integrates mobile accounts, allowing users to manage funds associated with their mobile payment services directly through the platform. This seamless integration ensures that all your Mercantil financial instruments are connected and manageable from one central point. * **Setting Up Alerts and Notifications:** Beyond just viewing, many platforms allow users to customize alerts for various activities. For instance, you could set up notifications for large withdrawals, low balances, or when a credit card payment is due. These proactive alerts help users stay on top of their finances and react quickly to any unusual activity. This integrated approach to account and card management empowers users with a comprehensive overview and immediate control, making financial planning and monitoring significantly more efficient.Digital Payments and Recharge Services

The scope of digital payments through Mercantil en Línea extends beyond simple bill payments, embracing a broader ecosystem of digital transactions: * **Scheduled and Recurring Payments:** For regular expenses like rent, mortgage, or subscriptions, Mercantil en Línea often allows users to set up scheduled or recurring payments. This automation ensures timely payments, reduces the risk of late fees, and simplifies budgeting. * **Mobile Top-Ups and Recharges:** As mentioned, the ability to instantly recharge mobile phone credit or other prepaid services is a key convenience. This is particularly valuable in economies where mobile phones are primary tools for communication and financial transactions. * **Payments to Third Parties/Services:** Beyond typical utility bills, the platform may support payments to a wider range of merchants or service providers, expanding the utility of your digital banking. This could include school fees, club memberships, or even donations. * **Interbank Transfers (ACH/Wire):** While basic transfers are common, advanced platforms offer more sophisticated interbank transfer options, including higher limits or specific types of wire transfers for larger sums or international transactions, adhering to strict security protocols. * **QR Code Payments (if applicable):** Some modern banking apps integrate QR code scanning for quick and easy payments at participating merchants, further bridging the gap between online and offline commerce. These advanced digital payment and recharge services highlight Mercantil en Línea's role not just as a financial management tool, but as an integral part of the digital economy, facilitating a wide array of transactions with efficiency and security.The YMYL Aspect: Trust and Responsibility in Digital Banking

In the realm of online services, "Your Money or Your Life" (YMYL) content refers to topics that can significantly impact a person's health, financial stability, or safety. Online banking, by its very nature, falls squarely into the YMYL category. This designation places an immense responsibility on financial institutions like Mercantil Banco Universal to ensure the highest standards of accuracy, security, and trustworthiness for services like Mercantil en Línea. For users, understanding the YMYL implications of online banking means recognizing both the immense benefits and the inherent responsibilities. **Trustworthiness from the Bank's Side:** * **Data Confidentiality:** As stated, "La información mostrada en esta página es confidencial." This isn't just a statement; it's a legal and ethical commitment. Banks invest heavily in robust encryption, firewalls, and secure servers to protect sensitive financial data from breaches. * **Regulatory Compliance:** Financial institutions operate under strict regulatory frameworks designed to protect consumers. Mercantil Banco Universal, as a long-standing entity "rumbo a sus 100 años de actividad bancaria en venezuela," operates within established banking laws, ensuring adherence to security and privacy standards. * **Reliability and Uptime:** For YMYL services, consistent availability is crucial. Users need to be able to access their funds and perform transactions whenever necessary. Banks strive for high system uptime and have robust disaster recovery plans. * **Transparency and Support:** Clear communication about security features, terms of service, and readily available customer support for issues or suspicious activities builds user trust. **Responsibility from the User's Side:** * **Strong Passwords:** Users are the first line of defense. Employing unique, complex passwords for Mercantil en Línea and never sharing them is non-negotiable. * **Vigilance Against Phishing:** Users must be educated to identify and avoid phishing emails or fraudulent websites that attempt to trick them into revealing login credentials. Always access Mercantil en Línea directly through the official website or app. * **Secure Devices:** Ensuring the device used for online banking (computer, smartphone) is protected with up-to-date antivirus software, firewalls, and operating system updates is critical. * **Monitoring Account Activity:** Regularly checking transaction history on Mercantil en Línea allows users to quickly identify and report any unauthorized activity. * **Confidentiality of Information:** Users must treat all information related to their online banking, including usernames, passwords, and security questions, as highly confidential. The YMYL nature of Mercantil en Línea means that every feature, every security protocol, and every piece of user guidance is designed with the profound impact on a user's financial well-being in mind. It's a partnership between the bank's robust systems and the user's diligent practices to ensure secure and effective financial management.Mercantil Banco Universal: A Legacy of Trust

The reliability and trustworthiness of an online banking service are inextricably linked to the reputation and history of the financial institution behind it. In the case of Mercantil en Línea, the service is backed by Mercantil Banco Universal, an entity with a profound and enduring legacy in Venezuela. The statement "Mercantil banco universal, entidad financiera rumbo a sus 100 años de actividad bancaria en venezuela" speaks volumes about its established presence and long-term commitment to its clientele. Approaching a century of operation is a remarkable milestone for any financial institution. It signifies: * **Stability and Resilience:** Nearly 100 years of activity demonstrates an unparalleled ability to navigate economic shifts, political changes, and technological revolutions. This longevity is a testament to sound management, adaptive strategies, and a deep understanding of the Venezuelan financial landscape. * **Accumulated Expertise:** Decades of experience translate into profound expertise in banking operations, risk management, and customer service. This institutional knowledge forms the bedrock upon which modern services like Mercantil en Línea are built. * **Established Trust:** Trust is earned over time. For generations, Mercantil Banco Universal has been a custodian of people's savings and a facilitator of economic activity. This long-standing relationship with its customers instills confidence in its digital offerings. When users log into Mercantil en Línea, they are not just interacting with a website; they are engaging with an institution that has proven its reliability over nearly a century. * **Commitment to Innovation:** To remain relevant for such a long period, Mercantil Banco Universal must have consistently embraced innovation. The development and continuous enhancement of Mercantil en Línea are clear indicators of this forward-thinking approach, ensuring that the bank remains at the forefront of financial technology. * **Regulatory Adherence:** A bank with such a long history has undoubtedly built strong relationships with regulatory bodies and consistently adhered to the highest standards of financial conduct. This compliance further reinforces its credibility and trustworthiness. In essence, Mercantil Banco Universal's nearly 100-year journey provides a powerful foundation of authority and trustworthiness for its Mercantil en Línea service. It assures users that their financial transactions are handled by an experienced and reliable institution, making their digital banking experience not just convenient, but also secure and dependable.Troubleshooting Common Issues and Getting Support

Even with the most robust and user-friendly platforms like Mercantil en Línea, users may occasionally encounter issues or require assistance. Knowing how to troubleshoot common problems and access reliable support is crucial for a seamless online banking experience. Mercantil Banco Universal, as a responsible financial institution, provides various channels for customer assistance. **Common Issues and Quick Fixes:** * **Login Problems:** * **Incorrect Username/Password:** Double-check your "usuario" (username) or debit card number and "clave de internet" (internet password) for typos. Remember that passwords are case-sensitive. * **Forgotten Password:** Mercantil en Línea will typically have a "Forgot Password" or "Recover Password" option on the login page. This usually involves verifying your identity through security questions or a code sent to your registered phone/email. * **Account Locked:** Multiple failed login attempts can lock your account for security reasons. You'll need to follow the prompts to unlock it, which might involve contacting customer support or using a self-service unlock feature. * **Transaction Delays/Errors:** * **Pending Transactions:** Some transactions, especially interbank transfers, might take time to process. Check the estimated processing time provided by the bank. * **Insufficient Funds:** Ensure you have enough balance for the transaction. * **Technical Glitch:** If a transaction fails repeatedly, note down any error messages and try again after a few minutes. If the problem persists, contact support. * **Website/App Performance:** * **Slow Loading:** Check your internet connection. Clear your browser's cache and cookies, or try a different browser/device. Ensure your Mercantil en Línea app is updated to the latest version. * **Maintenance:** Banks periodically perform system maintenance, which might temporarily affect service availability. Check the bank's official website or social media for announcements. **Accessing Support:** For issues that cannot be resolved through self-troubleshooting, Mercantil Banco Universal provides dedicated customer support channels. While the provided data doesn't detail these, standard banking practices include: * **Customer Service Hotlines:** A dedicated phone number for immediate assistance with technical issues, account inquiries, or reporting suspicious activity. * **Online Chat/Messaging:** Many modern online banking platforms integrate a chat feature, allowing users to communicate directly with a customer service representative within the Mercantil en Línea portal. * **Email Support:** For less urgent inquiries, an official email address for customer support is usually available. * **FAQs and Help Sections:** The Mercantil en Línea website itself will likely host an extensive FAQ section and a help center with guides on how to use various features and troubleshoot common problems. * **Social Media Channels:** Banks often use their official social media pages to announce service updates, address common queries, and direct users to appropriate support channels. * **Branch Visits:** For complex issues or those requiring in-person verification, visiting a Mercantil Banco Universal branch remains an option. When contacting support, always be prepared to verify your identity. Remember, never share your full password or sensitive personal information over unverified channels. Mercantil Banco Universal's commitment to nearly 100 years of service implies a robust support infrastructure to assist its Mercantil en Línea users.The Future of Banking: Innovation with Mercantil en Línea

The digital banking landscape is constantly evolving, driven by technological advancements and changing consumer expectations. For a service like Mercantil en Línea, staying ahead of the curve means continuous innovation. Mercantil Banco Universal's long history suggests an inherent capacity for adaptation and foresight, crucial qualities for navigating the future of finance. The trajectory of online banking points towards several key areas of development, and Mercantil en Línea is likely to embrace many of these: * **Enhanced Personalization:** Future iterations of Mercantil en Línea could leverage AI and machine learning to offer highly personalized financial advice, spending insights, and tailored product recommendations based on individual user behavior and financial goals. * **Seamless Integration with Fintech:** Expect deeper integration with third-party financial technology (fintech) applications, allowing users to manage investments, budgeting apps, or even cryptocurrency holdings directly or indirectly through their Mercantil en Línea portal. Open banking initiatives will likely drive this. * **Advanced Security Measures:** As cyber threats become more sophisticated, Mercantil en Línea will continue to bolster its security. This could include wider adoption of biometric authentication (voice, facial recognition), behavioral biometrics (analyzing typing patterns, mouse movements), and quantum-resistant encryption. * **Voice Banking and Conversational AI:** The ability to conduct transactions or inquire about balances using voice commands through smart speakers or virtual assistants could become a standard feature, making banking even more hands-free and accessible. * **Blockchain and Distributed Ledger Technology (DLT):** While still nascent in retail banking, blockchain could potentially revolutionize cross-border payments, making them faster, cheaper, and more transparent. Mercantil en Línea might explore DLT for certain high-volume or international transactions. * **Hyper-Convenience and "Invisible" Banking:** The ultimate goal is to make banking so seamless that it becomes almost invisible. Think of automated bill payments, smart savings features that move money for you, or instant loan approvals based on real-time financial data, all orchestrated through Mercantil en Línea. * **Financial Wellness Tools:** Beyond just transactions, Mercantil en Línea could increasingly offer tools focused on overall financial wellness, including debt management programs, retirement planning simulators, and personalized financial literacy modules. Mercantil Banco Universal's journey "rumbo a sus 100 años de actividad bancaria" is a testament to its enduring commitment to its customers. By continuously investing in and evolving Mercantil en Línea, the bank not only secures its position in the digital age but also ensures that its users are equipped with the most advanced and secure tools to manage their financial lives, wherever they may be. The future of banking is digital, intelligent, and deeply integrated into our daily lives, and Mercantil en Línea is poised to be a significant part of that transformation.Conclusion

**Mercantil en Línea** stands as a testament to the evolution of modern banking, offering Mercantil Banco Universal customers an unparalleled level of control and convenience over their finances. As we've explored, this robust internet banking service transcends basic transactions, providing a secure gateway to a comprehensive suite of financial tools – from everyday transfers and bill payments to advanced account and card management. Its foundation on stringent security measures and the nearly century-long legacy of trust built by Mercantil Banco Universal underscores its reliability as a YMYL service, where the protection of your financial well-being is paramount. The ability to "manejar tus finanzas desde cualquier lugar" is not just a slogan; it's the core promise of Mercantil en Línea, empowering users to access their accounts, credit, debit, and mobile banking services with ease and confidence. As the digital landscape continues to evolve, Mercantil en Línea is poised to integrate even more innovative features, ensuring that Mercantil Banco Universal remains at the forefront of providing accessible, secure, and intelligent financial solutions. We encourage you to explore the full potential of Mercantil en Línea if you are a Mercantil Banco Universal customer. Take advantage of its features to streamline your financial life, gain greater control, and enjoy the peace of mind that comes with secure online banking. What has been your experience with Mercantil en Línea? Share your thoughts and insights in the comments below, or explore other articles on our site for more valuable financial insights.

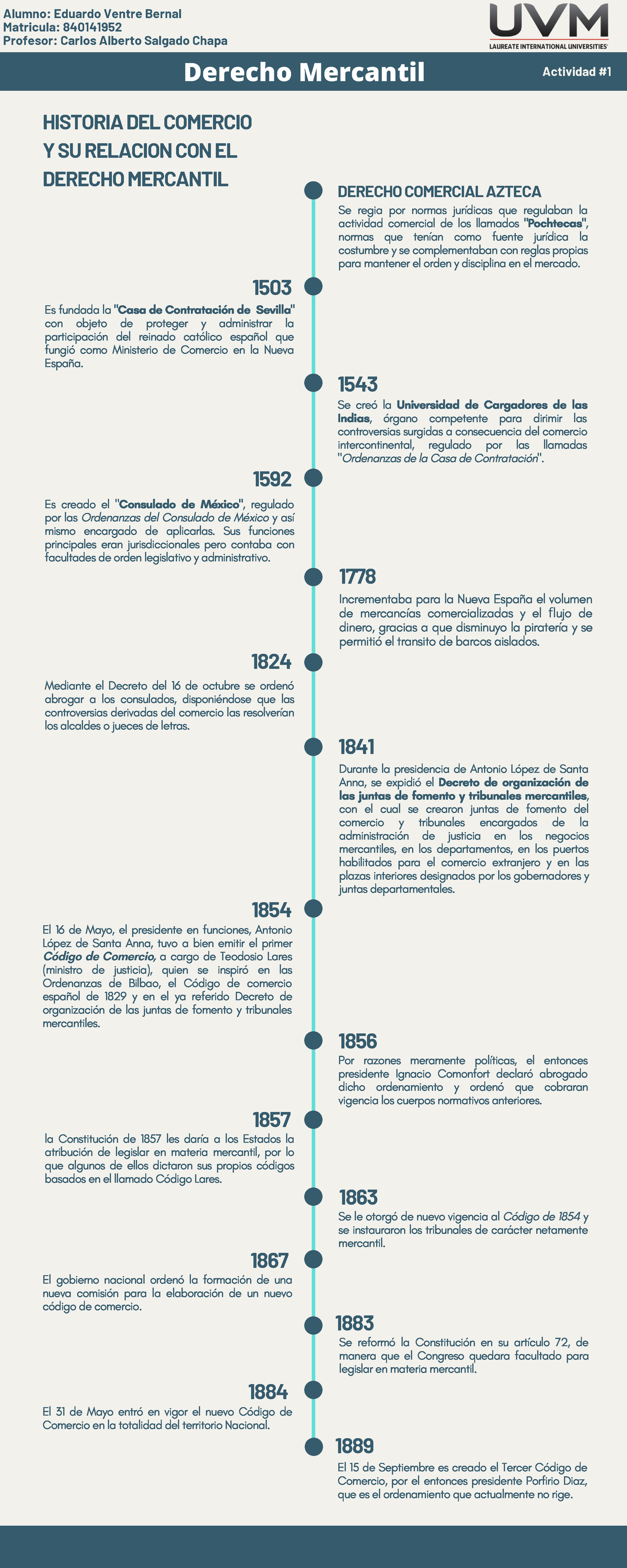

Linea Del Tiempo Derecho Mercantil - MXEDUSA

Tipos De Contratos De Compraventa Mercantil - Image to u

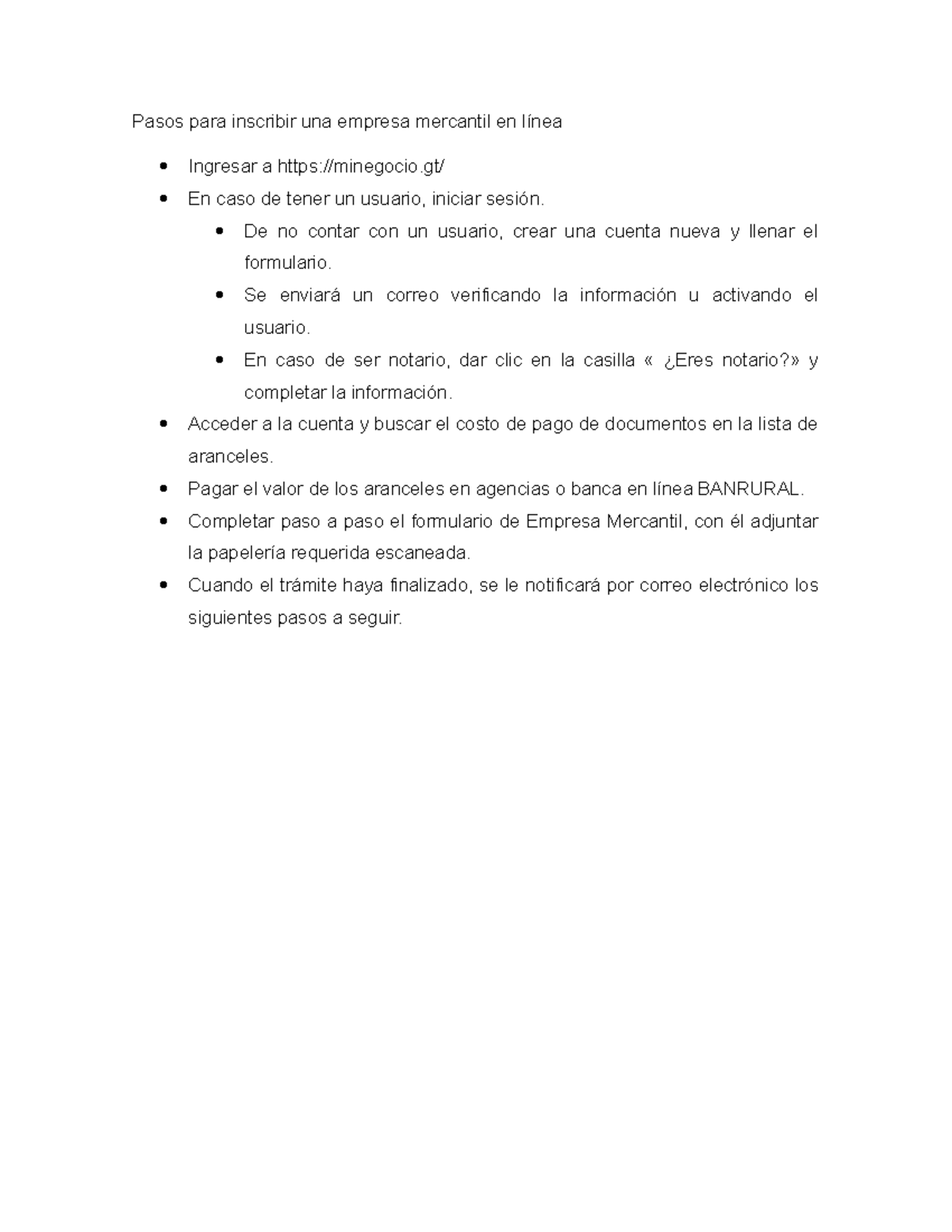

Pasos para inscribir una empresa mercantil en línea - Derecho Mercantil