The Roaring Kitty Effect: Twitter, GME & Beyond

In the tumultuous world of finance, few figures have captured the imagination and challenged the status quo quite like Roaring Kitty, the online persona of Keith Gill. His presence on platforms like Twitter and YouTube didn't just spark conversations; it ignited a movement, transforming the conventional understanding of market dynamics and retail investor power. His recent re-emergence has once again put the spotlight on his unique approach to investing and the profound impact he has on the financial landscape, proving that when the "roaring" begins, it's a force that simply cannot be stopped.

From the depths of detailed financial analysis to the virality of internet memes, Roaring Kitty embodies a fascinating blend of expertise and relatability. This article delves deep into the phenomenon that is Roaring Kitty, exploring his journey, his investment philosophy, and the enduring legacy of his digital footprint, particularly on Twitter, where his cryptic posts often send ripples through the market. We will examine how his actions led to a seismic shift, turning what once seemed like small "fountains" of individual investors into formidable "titans" capable of challenging established financial giants.

Table of Contents

- Who is Roaring Kitty? A Biography of Keith Gill

- The Genesis of a Movement: Deep Value & Early Fountains

- Roaring Kitty on Twitter: The Digital Battlefield

- The GME Saga: When Fountains Turned into Titans

- The Resurgence: Roaring Back in 2024

- The Unstoppable Roar: Market Impact and Legacy

- Investment Philosophy: Hunting Stocks and Pouncing on Opportunities

- Navigating the Roar: Lessons for Investors

Who is Roaring Kitty? A Biography of Keith Gill

Keith Patrick Gill, known to the internet as "Roaring Kitty" on YouTube and "DeepF***ingValue" (DFV) on Reddit's r/wallstreetbets, is an American financial analyst and investor who rose to prominence in early 2021 for his role in the GameStop short squeeze. Before his meteoric rise to internet fame, Gill was a relatively unknown figure in the financial world. He held a Chartered Financial Analyst (CFA) designation and worked in various roles, including as a financial wellness education specialist for MassMutual. His background as an analyst, coupled with his passion for deep value investing, laid the groundwork for the extraordinary events that would soon unfold.

Gill’s journey from a quiet analyst to a global financial icon is a testament to the power of conviction and transparent communication. He shared his investment thesis on GameStop (GME) through YouTube livestreams and Reddit posts, meticulously detailing his research and belief in the company's undervalued potential. His calm demeanor and reasoned arguments, even amidst intense scrutiny and skepticism, resonated deeply with a new generation of retail investors. He became the "knight" in this unfolding financial saga, responsible for illuminating opportunities and, in a sense, "creating fountains" of interest that would eventually lead to a monumental "roaring" in the markets.

Personal Data & Biodata

| Full Name | Keith Patrick Gill |

| Online Aliases | Roaring Kitty (YouTube), DeepF***ingValue (Reddit) |

| Nationality | American |

| Profession | Financial Analyst, Investor |

| Education | Stonehill College (Accounting) |

| Notable Achievements | Catalyst for the GameStop Short Squeeze of 2021 |

| Investment Style | Deep Value Investing |

The Genesis of a Movement: Deep Value & Early Fountains

Keith Gill's story is not one of a sudden, lucky gamble, but rather the culmination of years of diligent research and a steadfast belief in his investment philosophy: deep value investing. This approach involves identifying companies whose stock prices are trading below their intrinsic value, often due to market misconceptions or temporary setbacks. For Gill, GameStop was precisely such a company. He saw potential where others saw a dying brick-and-mortar retailer, heavily shorted by institutional investors.

Long before the "roaring" became a global phenomenon, Gill was quietly building his position in GME and sharing his thesis. He believed the company was undervalued, and that a turnaround, driven by new management and a shift in strategy, was possible. This was his initial act of "creating fountains"—laying the groundwork, sharing his insights, and inviting others to examine the data. He meticulously documented his trades and analysis on Reddit and through his YouTube channel, demonstrating transparency that built immense trust within the burgeoning online investment community. His consistent belief, even when the stock price was stagnant or falling, was a testament to his conviction. It was as if he and his early followers "must have started creating fountains the day before the" massive market event, preparing the ground for what was to come.

Roaring Kitty on Twitter: The Digital Battlefield

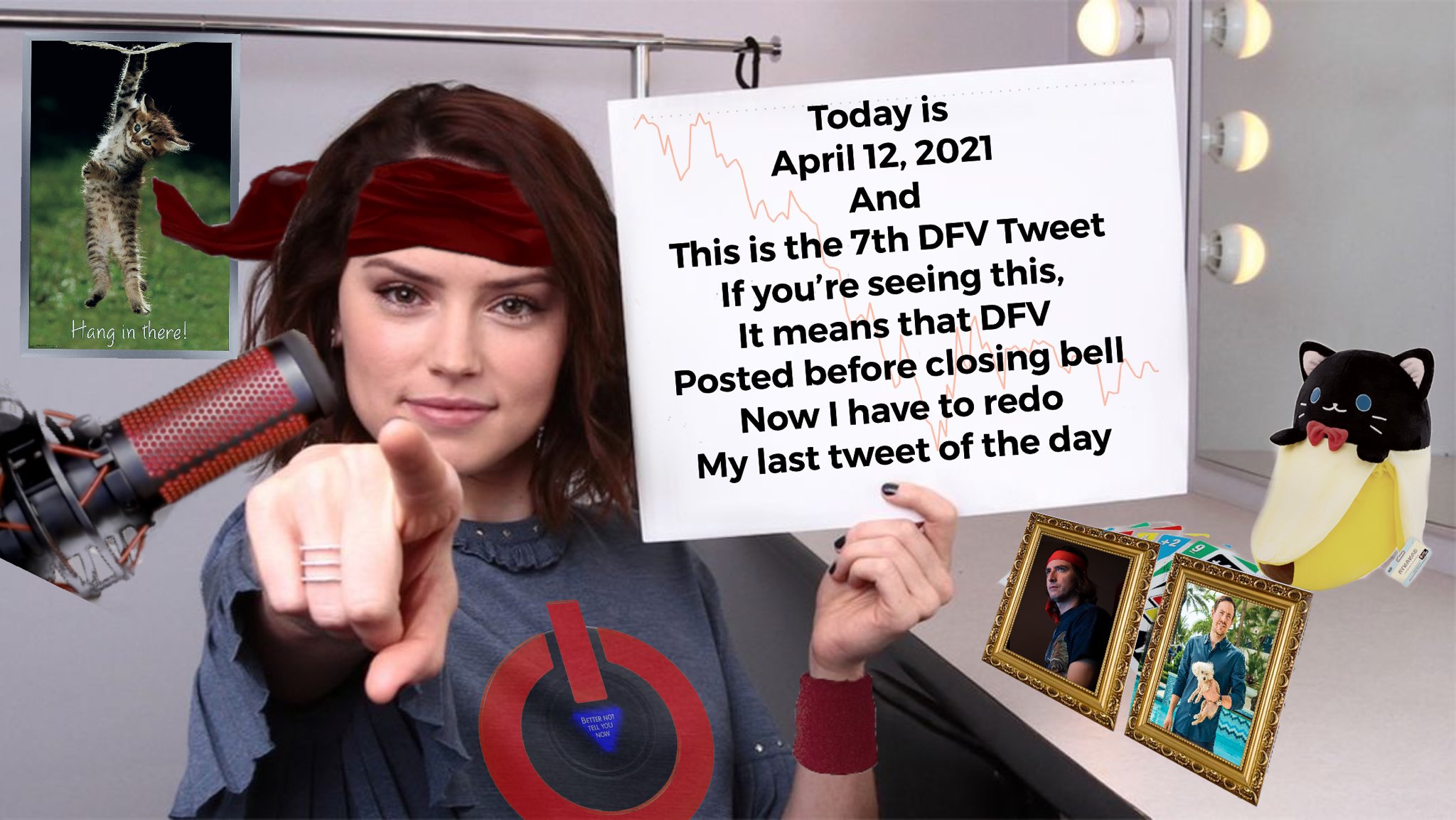

While Reddit was his initial forum for detailed analysis, Twitter became Roaring Kitty's real-time communication channel, a digital battlefield where cryptic memes and short video clips spoke volumes. His Twitter account, a verified presence, became a crucial pulse point for the GameStop saga. Unlike traditional financial analysts who rely on lengthy reports, Gill communicated through a unique blend of financial insight and internet culture. His tweets were often abstract, featuring movie clips, animated characters, or simple emojis, yet each one was meticulously interpreted by his followers as a signal, a mood indicator, or even a strategic hint.

This unconventional communication style transformed Twitter into an integral part of the "roaring" phenomenon. His followers, a vast decentralized network of retail investors, eagerly awaited his posts, dissecting every frame and soundbite for meaning. It was through this platform that the collective energy of the retail movement found a voice and a direction, demonstrating how a single individual, armed with conviction and a strong social media presence, could challenge the established financial order. The interaction on his Twitter feed, often filled with "upvotes" and enthusiastic replies, showed the fervent support he commanded, turning simple tweets into powerful rallying cries.

Decoding the Memes and Metaphors

A significant part of Roaring Kitty's appeal and influence on Twitter lay in his mastery of memes and metaphors. He didn't just tweet; he curated a narrative through pop culture references that resonated deeply with his audience. For instance, the concept of "the roaring is depicted to be an endless night, meaning it can't be stopped" found its expression in various forms, suggesting an unstoppable force of retail buying against short sellers. His use of lion emojis or specific movie scenes conveyed a sense of resilience and determination, implying that the collective effort of individual investors was an unyielding tide.

Similarly, the idea that "the fountains turn into titans, meaning there is nothing to seal" was visually represented through the growing strength of the retail movement. What started as small, individual investments—the "fountains"—grew into a powerful, unified force—the "titans"—that short-selling hedge funds found impossible to contain. These metaphors weren't just for entertainment; they served as a form of strategic communication, fostering a sense of unity and shared purpose among his followers. They allowed complex market dynamics to be understood through relatable cultural touchstones, making the financial world accessible and engaging for a broader audience. His protected tweets, while sometimes cryptic, were always under intense scrutiny, as the community tried to decipher the deeper meaning behind each post.

The GME Saga: When Fountains Turned into Titans

The GameStop short squeeze of early 2021 was the quintessential moment when the "fountains turned into titans." For months, Keith Gill had been advocating for GME, buying shares and options, and sharing his thesis. Institutional investors, primarily hedge funds, held massive short positions, betting on GameStop's demise. This created a highly volatile situation: if the stock price rose significantly, these short sellers would face immense losses, potentially forcing them to buy back shares to cover their positions, thus driving the price even higher in a "short squeeze."

Fueled by Gill's persistent analysis and the collective energy of online communities like Reddit's r/wallstreetbets, retail investors began buying GME shares en masse. This coordinated buying pressure, amplified by the social media buzz around Roaring Kitty, sent the stock price skyrocketing. What followed was an unprecedented showdown between individual investors and powerful hedge funds, resulting in billions of dollars in losses for the latter. "Once the roaring happens, they're able to escape the dark world as titans," became a fitting metaphor for the retail investors who, by participating in this collective action, felt empowered and liberated from the perceived dominance of institutional finance. This event wasn't just about money; it was about a paradigm shift, a demonstration of collective power that reverberated across global financial markets.

The Resurgence: Roaring Back in 2024

After a period of relative silence following the initial GME saga, Roaring Kitty made a dramatic return to Twitter in May 2024, sending shockwaves through the financial world. His first posts, once again cryptic and meme-laden, instantly reignited interest in GameStop and other "meme stocks." This resurgence demonstrated the enduring power of his influence; a single tweet from his account could trigger massive trading volumes and price swings, proving that "the roaring" was not a fleeting event but an ongoing, potentially "endless night" of market disruption that "can't be stopped."

His return was met with a mix of excitement, speculation, and caution. Regulators and market participants closely watched his activity, aware of the potential for market volatility. This period saw GameStop's stock price surge once again, driven by renewed retail investor enthusiasm and the anticipation of Gill's next move. His consistent engagement, albeit sporadic, continued to highlight the power of social media in shaping market narratives and influencing investor behavior, solidifying his status as a unique and formidable force in modern finance.

The Wolverine Capital Share Delivery Explained

One of the most intriguing and recent developments surrounding Roaring Kitty's 2024 return involved a specific financial maneuver that captured significant attention: the potential delivery of 4.1 million shares of GME to him. This highly anticipated event stemmed from his significant options positions. Options contracts give the holder the right, but not the obligation, to buy or sell a stock at a specified price (strike price) by a certain date. When these options are "in the money" (meaning the strike price is favorable compared to the current market price) and exercised, they result in the delivery of actual shares.

The specific reference to "Wolverine capital must now deliver 4.1 million shares of gme to roaring kitty by end of market day (possibly after hours) tomorrow (friday june 14, 2024) plus more info 🤯 upvotes" points to a critical moment where a counterparty, in this case, Wolverine Capital (or a clearing firm facilitating the trade for them), would be obligated to provide a substantial block of GME shares to Gill. This isn't just a transaction; it's a public display of the scale of his investment and the impact of his options strategy. The sheer volume of shares involved underscores the depth of his conviction and the significant capital he deployed, transforming his theoretical gains from options into tangible ownership of millions of GameStop shares. This kind of large-scale share delivery can have ripple effects, influencing market sentiment and liquidity, and it perfectly illustrates how his strategic moves can trigger significant market events.

The Unstoppable Roar: Market Impact and Legacy

The impact of Roaring Kitty extends far beyond the GameStop saga. He fundamentally altered the perception of retail investors, demonstrating that their collective action could challenge and even disrupt the established order of Wall Street. "The roaring is depicted to be an endless night, meaning it can't be stopped," is a metaphor that perfectly encapsulates this enduring legacy. It suggests that the genie of retail empowerment is out of the bottle, and its influence on markets is a permanent fixture.

His actions highlighted vulnerabilities in the financial system, particularly concerning short selling and market transparency. Regulators and lawmakers have since scrutinized market structures and practices, prompted by the events he helped catalyze. Furthermore, Roaring Kitty inspired a new generation of investors to engage with financial markets, encouraging them to research, question, and participate actively rather than passively deferring to institutional wisdom. His story serves as a powerful reminder that information, conviction, and collective action, amplified by social media, can create an "unstoppable roar" that echoes through the corridors of finance, shaping its future in unpredictable ways. This ongoing "roaring" could be a long and transformative period for market dynamics.

Investment Philosophy: Hunting Stocks and Pouncing on Opportunities

At the core of Roaring Kitty's success is a disciplined and methodical investment philosophy, often described as "deep value investing." He’s not a day trader or a speculative gambler; he’s a deep value investor who meticulously researches companies, identifies those he believes are fundamentally undervalued, and then invests with conviction for the long term. This approach is "a method for hunting stocks and pouncing on investment opportunities" that others might overlook or dismiss. He seeks out companies with strong underlying assets, potential for turnaround, or significant competitive advantages that are not reflected in their current stock price.

His strategy involves patiently accumulating positions, even when the market is skeptical, and then holding them through volatility, trusting in his fundamental analysis. This long-term perspective contrasts sharply with the fast-paced, short-term trading often associated with online forums. His success with GameStop, while appearing sudden to many, was the result of years of research and a patient accumulation of shares and options, demonstrating that a well-researched, conviction-based approach can yield extraordinary results, especially when combined with a catalyst like a short squeeze.

Roaring Kitty's YouTube Channel and Community

Before his Twitter fame, Keith Gill cultivated a dedicated following on his "Roaring Kitty channel" on YouTube. It was here that he would "live stream regularly," sharing his detailed investment theses, conducting Q&A sessions, and providing updates on his portfolio. This channel was instrumental in building the initial community around his GameStop investment. He presented himself as an ordinary investor, sitting in front of a computer, patiently explaining his rationale, charts, and data points. This raw, unpolished authenticity resonated deeply with viewers, many of whom were new to investing or felt disenfranchised by traditional financial institutions.

His YouTube presence fostered a sense of community and shared learning. He wasn't just telling people what to do; he was showing them his process, encouraging critical thinking, and engaging directly with their questions. This transparency and willingness to share his thought process made him a trusted figure. The phrase "My roaring kitty channel might be helpful, I’m a deep value investor and I live stream regularly" perfectly encapsulates his commitment to educating and empowering others through his own investment journey. His followers weren't just spectators; they were active participants in a collective learning experience, drawn to his expertise and genuine passion for investing.

Navigating the Roar: Lessons for Investors

The saga of Roaring Kitty offers several invaluable lessons for both seasoned and novice investors navigating the complexities of modern markets. Firstly, it underscores the importance of independent research and conviction. Gill's success stemmed from his deep understanding of GameStop's fundamentals, not from following trends or hype. Secondly, it highlights the growing power of retail investors and the democratizing effect of social media on finance. What was once the exclusive domain of institutional giants is now increasingly influenced by collective action from individual investors.

However, it also serves as a cautionary tale about volatility and risk. While the "roaring" can lead to significant gains, it also carries substantial risks, and not every "fountain" will turn into a "titan." Investors should always conduct their own due diligence, understand the risks involved, and never invest more than they can afford to lose. The "legend shouldn't be seen as literally," meaning that while the Roaring Kitty phenomenon is inspiring, individual results will vary, and the market is inherently unpredictable. Ultimately, Roaring Kitty's legacy encourages a more informed, engaged, and perhaps more equitable financial landscape, where individual investors have a louder voice than ever before.

Conclusion

Roaring Kitty, through his meticulous research, transparent communication, and compelling presence on platforms like Twitter and YouTube, has carved out a unique and indelible mark on the financial world. He transformed the perception of retail investors from fragmented individuals into a formidable, collective force, demonstrating that when the "roaring" truly begins, it is an "endless night" of market disruption that "can't be stopped." His story is a testament to the power of conviction, the impact of deep value investing, and the unprecedented influence of social media in shaping market narratives.

From the early "fountains" of his initial investments and detailed analyses to the moment those "fountains turned into titans" during the GameStop short squeeze, Keith Gill has proven to be a pivotal figure. His recent return to Twitter in 2024, complete with the highly anticipated share delivery from Wolverine Capital, reaffirms his enduring relevance and the continued fascination with his strategic moves. As the financial landscape continues to evolve, the lessons from Roaring Kitty’s journey – about research, community, and challenging the status quo – remain more pertinent than ever. We encourage you to delve deeper into the world of investing, always conduct your own research, and share your thoughts on the Roaring Kitty phenomenon in the comments below. What do you think his ultimate legacy will be?

Roaring Kitty on Twitter: "$GME https://t.co/tKJwOX4Q2q" / Twitter

Roaring Kitty (@TheRoaringKitty) / Twitter

Roaring Kitty on Twitter: "https://t.co/58Tz8GEc0u" / Twitter